It may come as no surprise that the majority of African telecom operators have Twitter accounts. To succeed in an increasingly competitive marketplace, every companies must ensure a positive user experience. What better way to communicate with customers than through social media, most notably Facebook and Twitter? Twitter feeds can supply news and product information. In turn, consumers can act as PR vehicles. Moreover, no force in business is greater than the power of one – the consumer. Personal interaction between company and consumer not only spurs immediate user retention, but seeds word-of-mouth recommendation.

That said, some telecom operators in Africa are more involved in social media efforts. Not surprisingly, the most influential hail from Nigeria, Kenya, South Africa. All of these nations have substantial online user bases where customers are engaged with social media. Essentially, these companies have a greater chance of having their message spread and adopted throughout the Internet.

Klout believes that every person who creates content online has influence. Their goal is to understand what they are influential about and who they are influencing. Klout analyzes interaction among 10 networks including Facebook, Twitter, and LinkedIn, with more on the way. They look at how many people you influence (true reach), how much you influence people (amplification), and the influence of the people in your reach (your network). Then, the algorithm assigns a single score from 10-100 indicating how meaningful/trustworthy/awesome an account is.

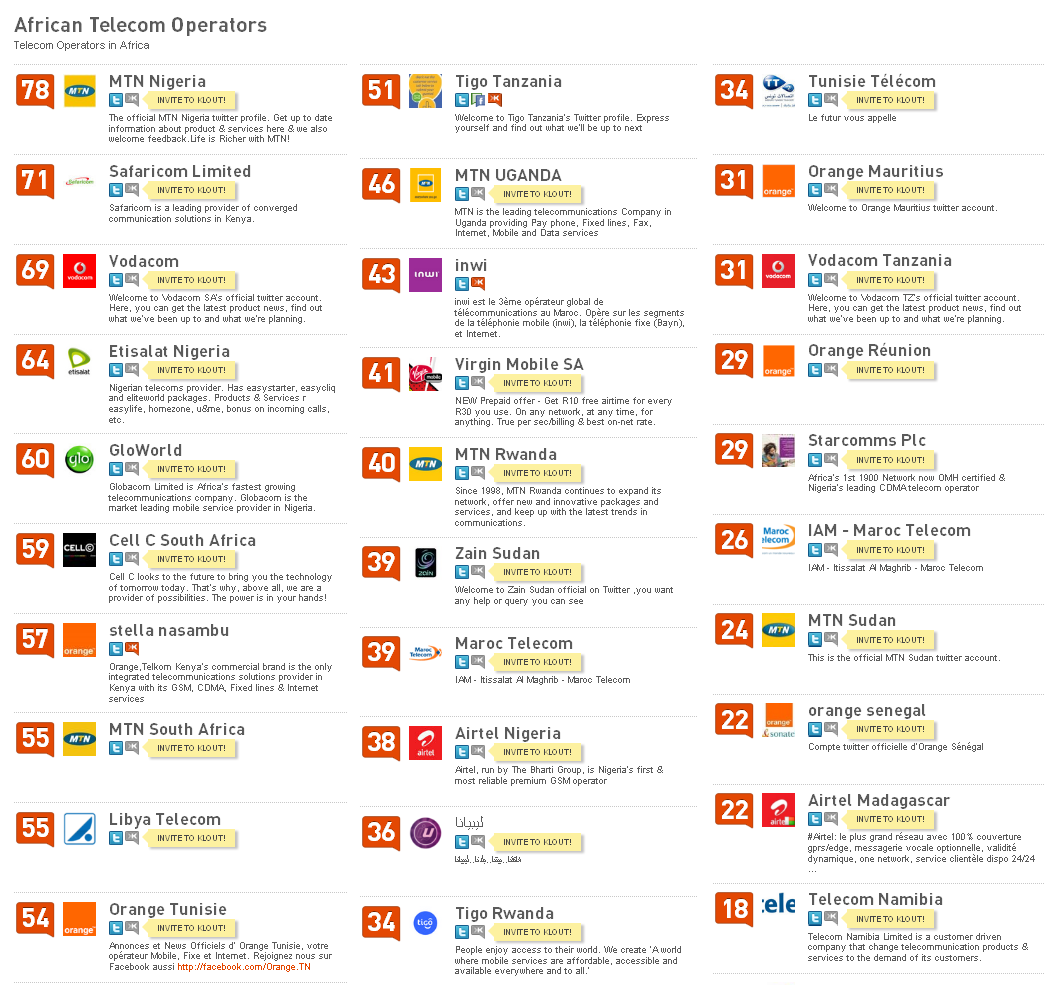

Klout scores for African telecom operators, based on @oafrica/african-telecom-operators Twitter list. {Klout}

Klout scores for African telecom operators, based on @oafrica/african-telecom-operators Twitter list. {Klout}

Using a Twitter list, sourced from the Wikipedia List of mobile network operators of the Middle East and Africa and a list of operators from Africa & Middle East Telecom Week, Klout is able to run each account through its algorithm to determine how strong of an influence the brand has across the Internet.

According to Klout, MTN Nigeria, Safaricom Kenya, and Vodacom SA are the most influential telecom operators in Africa. Impressively, Orange Kenya, Tigo Tanzania, and inwi Maroc all have Klout accounts. The PR teams at these telecoms are certainly ahead of the game in Africa, let alone globally. Also:

- Nigeria: MTN leads with a score of 78. Etisalat and Glo are near equals in terms of influence (64 and 60, respectively), with Airtel and Starcomms behind (38 and 29, respectively)

- South Africa: Vodacom leads with a score of 69. Cell C and MTN are nearly equal (59 and 55, respectively), with Virgin Mobile back at 41.

- Kenya: Safaricom leads with a score of 71. Orange is at a healthy score of 57.

- MTN clearly has a social media strategy in place. The company’s Twitter accounts for Uganda and Rwanda are considered influential (having a score over 40). Even more impressively, MTN Sudan yields a Klout score of 24 – very strong considering the small user-base of Sudanese Twitter users. The account only has 48 followers!

- Less influential, but active accounts include Telecom Namibia, Airtel Tanzania, Malawi Telecommunications.

- Other accounts have the lowest Klout score possible (10). Most of these were created but have sat dormant for at least a few months. They include Orange (Madagascar, Niger), Airtel (Niger, Uganda, Malawi), Comium (Gambia, Ivory Coast), and Sonatel (Senegal).

- Orange Niger actively Tweets, but only has 16 followers, suggesting a lack of social media users in Niger.

- Comium Gambia (3rd GSM operator in the country) Tweets a few times per month, and has 123 followers, but the influence appears nil.

- MTL (Malawi) has fairly low influence (16) despite a decent number of followers given the prevalence of Internet in Malawi (170).

![]()