FNB’s mobile money shows significant growth

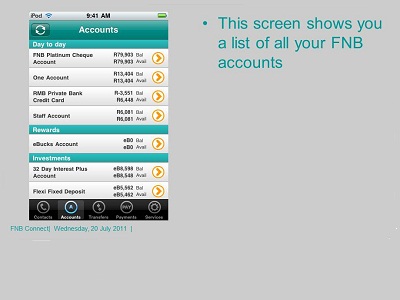

A view of the mobile account screen shot on the FNB app (image source: file photo)

FNB recorded a 150% growth in the number of cellphone banking transactions and 1384% eWallet growth comparing December 2010 and December 2011.

A view of the mobile account screen shot on the FNB app (image source: file photo)

2.4 million transactions were conducted on cellphones during December 2011 in Botswana, Namibia, Zambia, Swaziland and Lesotho. In total R214 million was transferred. In December 2010 it was only R986 000.

Botswana, the bank’s leading cellphone banking subsidiary outside South Africa, saw just over 1.3 million transactions, a 126% increase year-on-year.

International Telecommunications User (ITU) research indicated Botswana has 2.3 million cellphone users. Namibia recorded year-on-year growth of 155%, Zambia 308% and Swaziland 227%.

Ravesh Ramlakan, FNB Cellphone Banking Solutions CEO, says service growth reflect consumers’ increasing confidence in mobile handsets in the African market.

“Innovation has played a key role in growing cellphone banking across Africa. Our ability to adapt the service for use on any cellphone has been an important driver of this growth,” says Ramlakan.

Since inception, FNB eWallet has generated 407 110 original sends in its four African operations (Botswana, Swaziland, Lesotho and Zambia) at the end of December 2011. In Botswana, FNB eWallet original sends increased by 1236% year-on-year from December 2010 to December 2011.

eWallet allows FNB customers to send money to anyone within their borders. Recipients do not need a bank account as money is transferred instantly. With a pin code sent to their cellphones, recipients access cash by entering the code at FNB ATMs.

Yolande van Wyk, FNB eWallet Solutions CEO, says despite eWallet’s recent introduction to markets outside of South Africa, the service demonstrated continued potential future growth.

“A country like Zambia for example has 5.4 million mobile phone users and a large informal sector, making a solution such as eWallet ideal in helping bridge the financial services gap between the banked and the unbanked,” says Van Wyk.

Staff writer